Why It's Important to Teach Your Students Financial Literacy—and Three Ways to Do It

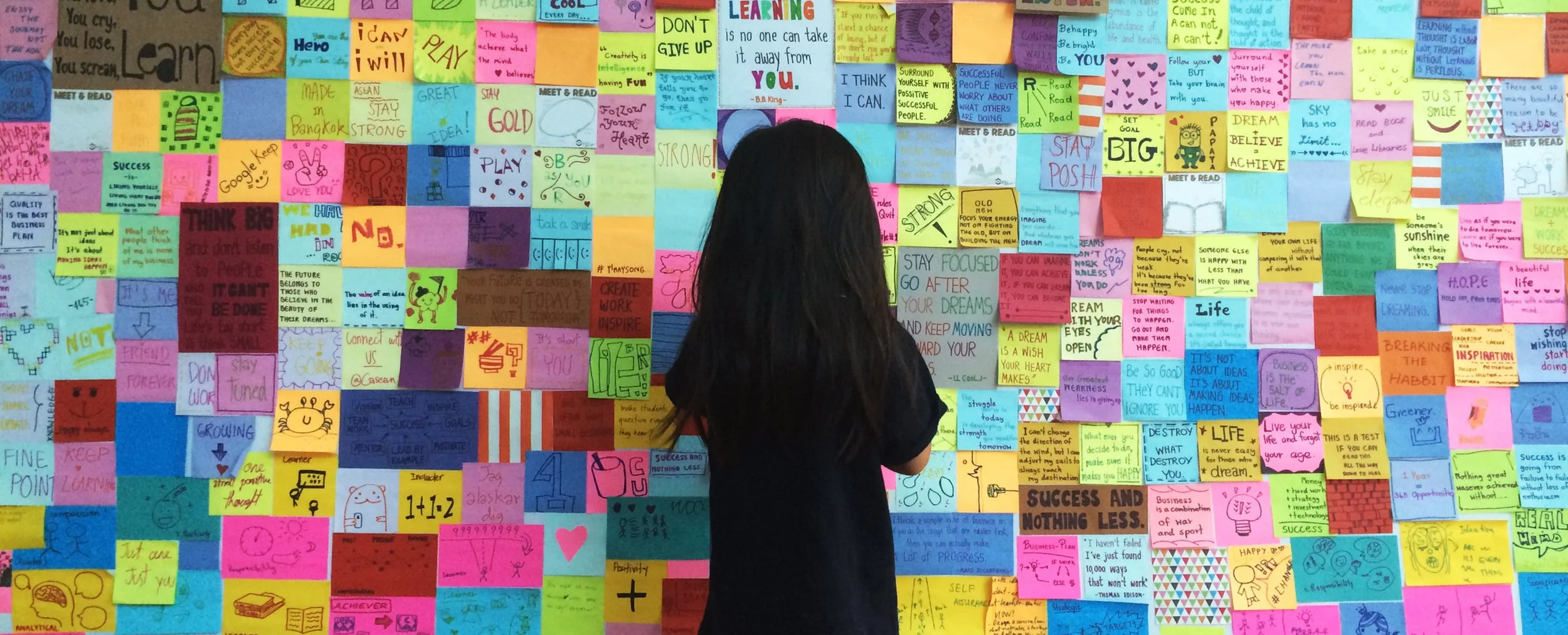

/In Oakland, CA, more than 60 students at James Madison Middle School gather to talk about money. The conversation is robust. One student shares his family’s experience saving for emergencies. Another group debates whether a new bike is a “want” or a “need.” Across the room, two young women are deep in conversation about college majors and future income.

Today’s young people face an overwhelming number of complex financial decisions. However, many are unprepared to make informed financial choices as they move into adulthood. In fact, three out of four young adults cannot answer basic financial questions.

Teaching financial literacy in the classroom is one promising way to improve financial capacity for today’s young people. Research shows that by the age of 12, students will develop an economic understanding that researchers describe as “essentially adult”. By including lessons on smart money habits early in their cognitive development, we can encourage young people to save money, foster family conversations, and empower students to be stewards of their own financial futures.